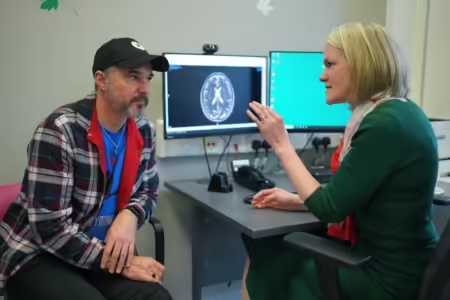

Friday’s front pages have a variety of different stories as their leads. Two domestic stories feature across several of the papers. According to several papers, Scotland’s first minister Humza Yousaf is in peril as the Scottish Greens say they will back a no-confidence motion against him. The world’s first “jab to stop skin cancer” is another popular story on the front pages, with the personalised vaccine being tested on UK patients.

Elsewhere, various celebrity stories and football make the front pages.

The UK back pages all lead on Manchester City’s 4-0 win over Brighton to move them within a point of the top spot – and with a game to spare.