Elementor #551608 September 21, 20231 Min Read Summary of the Top 6 headlines today Financial Times – Sunak sparks business backlash after U-turn on net zero pledges The Financial Times leads on the backlash against PM Rishi Sunak’s plans to push back the government’s net zero promises. Several car makers have heavily criticised the move. The paper says PM Sunak has “ignited a business backlash” and quotes Lisa Brankin, chair of Ford UK, saying the…

Author: WTX Business Team

CITY AM – CBI fights for survival CBI postpones crunch AGM amid ‘short term cash flow’ issues and race to raise £3m London business paper CITY AM SAYS The Confederation of British Industry (CBI)’s annual meeting meant to take place Wednesday has been postponed, prompting more concerns about the finances of the crisis-hit lobby group. Following a race to raise £3m within days of its scheduled annual meeting, the CBI announced its postponement in a…

Elon Musk: Social media platform X could go behind paywall US billionaire Elon Musk has suggested that users of his social media site X (formerly known as Twitter) may have to pay to access the platform. Musk was speaking to Israeli PM Benjamin Netanyahu when he made the announcement, saying a payment system was the only way to counter bots. “We’re moving to having a small monthly payment for use of the system,” Musk said. …

Elementor #551334 September 19, 20231 Min Read Summary of the Top 6 headlines today Financial Times – Germany leads censure of eastern EU states’ ban on Ukraine grain imports Germany has led condemnation from EU countries of Poland, Hungary and Slovakia for placing curbs on grain imports from Ukraine, reports the Financial Times, with Berlin accusing the states of “part-time solidarity” with the war torn nation. The front page image is of the US prisoners…

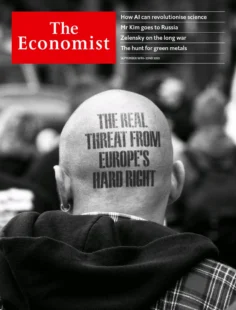

The Economist – The real threat from Europe’s hard right: A fresh wave of hard-right populism is stalking Europe THE ECONOMIST SAYS A spectre is haunting Europe: the spectre of a rising hard right. In Germany, the overtly xenophobic Alternative for Germany (afd) has surged to become the country’s second-most popular party. Its success is polarising domestic politics and it seems poised to triumph in state elections in the east next year. In Poland the…

CITY AM – City reform manifesto to be delayed until next year as investors warn of ‘report fatigue’ CITY AM SAYS A major report looking to draw up a “new market model” for the City has been delayed until next year as fears grow of “report fatigue” setting in across London, City A.M. can reveal. The Capital Markets Industry Taskforce (CMIT), headed by London Stock Exchange chief Julia Hoggett, called in L&G boss Sir Nigel Wilson…

Rental prices rise at fastest rate for nine years, figures show Rental prices rose by 12% in the year to August, according to estate agency Hamptons. It marks the highest rise since it started its survey in 2014. A typical monthly rent of a newly-let property is now £1,304, it said. The rise in the past 12 months was more than the increase seen over the four years to 2019, Hamptons said. Pressure on landlords…

Elementor #551206 September 18, 20231 Min Read Summary of the Top 6 headlines today Financial Times – Labour government would seek to rewrite Brexit deal, Starmer pledges The Financial Times leads on Labour’s Brexit plan if they win the next general election. Sir Keir Starmer plans to seek a “major rewrite” of Britain’s Brexit deal if his party wins the next general election. In an interview with the paper, Sir Keir says the current deal…

Elementor #551037 September 15, 20231 Min Read Summary of the Top 6 headlines today Financial Times – Arm shares leap 20% in biggest US IPO for 2 years Shares in chip designer Arm increased by 20% as it began trading on the Nasdaq exchange on Thursday, the Financial Times’ reports. It is the largest initial public offering on the US stock market in two years. In other news, the front page reports that Housing Secretary…

Sainsbury’s and Tesco loyalty card prices not as good as they seem, says Which? A leading consumer rights group says supermarket loyalty schemes may not be as good as they appear. Which? Says Sainsbury’s and Tesco are inflating the regular price advertised for a product so that the promotional prices offered to loyalty scheme members look like a better deal than they really are. But Sainsbury’s and Tesco say it’s not true. They are claiming…

Chick-fil-A to try again in UK four years after LGBT backlash Four years after failing to launch Chic-Fil-A in the UK, the American fast food chain will try again. The junk-food restaurant wants to open five restaurants in the UK – no sites have been chosen just yet, but the first will open in early 2025. In 2019, the company attempted to get into the UK market but faced a boycott over its founders’ support…

Workers start strike at US motor industry giants Three of the biggest US carmakers have seen more than 10,000 staff walkout in the latest industrial action. Work has stopped at three plants owned by General Motors (GM), Ford and Stellantis. Labour contracts expired on Thursday night and the union UAW said the firms had not put forward acceptable offers. The strikes could trigger higher prices for buyers and major disruption for the motor industry giants.…

Cash payments rise for first time in 10 years Cash payments rose for the first time in a decade last year amid a devastating cost of living crisis, as the British public struggled with rising prices. But the number of cash payments is still small in comparison with debit card use which accounted for half of all payments – the highest ever level. It’s quite common for consumers to use cash during financial troubles as…

Elementor #550915 September 14, 20231 Min Read Summary of the Top 6 headlines today Financial Times – EU launches subsidy probe into Chinese electric cars The Financial Times leads with the EU investigating China’s electric cars amid claims the “cheaper” vehicles are “flooding” global markets – it says the probe “could become one of the world’s biggest trade cases”. The paper also features more women going back to full-time employment given the rise in hybrid…

Strikes and wet weather cause UK economy to shrink The latest figures from the Office of National Statistics show the UK economy shrank more than expected in July, with the ONS pointing to strikes and wet weather as factors. The wet weather hit the construction and retail industries, causing the economy to contract by 0.5%. The figures were worse than what had been predicted and continue a trend of weak economic growth in the UK. …

New iPhone 15: Apple forced to ditch lightning charger The new iPhone will not feature its proprietary lightning charging port after the EU forced the change, Apple has confirmed. The tech giant said the iPhone 15 will use a USB-C cable as the “universally accepted standard.” Apple unveiled its newest iPhone at its annual event on Tuesday. An Apple Watch series was also unveiled with a more advanced clip. The updates from Apple have failed…

The Money Savings Expert has another top tip to help people with their savings.

First Wilko shop closures begin after rescue fails Tuesday will see the first Wilko shop closures after the collapsed retail chain failed to find a buyer. The first 24 shops – including ones in Liverpool, Cardiff, Acton and Falmouth will close on Tuesday, and a further 28 will close on Thursday. All of Wilko’s 400 shops will close by October. Around 12,500 staff will lose their jobs. Wilko fell into administration in August after struggling…

It doesn’t look like Sony is planning a name change for their next console, as they register trademarks for PS6, PS7, PS8, PS9, and PS10.

Elementor #550364 September 12, 20231 Min Read Summary of the Top 6 headlines today Financial Times – Wilko to close remaining 300 stores with 12,500 job losses as rescue mission fails The Financial Times reports on the fallen retailer Wilko, which is set to close its remaining stores – leading to thousands of redundancies. The paper says Wilko will “disappear from the high street next month” as another rescue deal fell through. Around 300 of…

Wilko rescue deal fails sparking huge job loss fears A Wilko rescue deal has fallen through, leaving the future of thousands of jobs uncertain. The billionaire owner of HMV, Doug Putman, hoped to keep up to 300 Wilko shops open, but his bid failed as rising costs complicated the deal. It means more than 10,000 workers face an uncertain future. Some of Wilko’s remaining stores could be sold to rival retailers, such as Poundland or…

The Economist – The New Middle East The Gulf’s boundless ambition to change the world THE ECONOMIST SAYS If you thought the Middle East was stagnant, think again. The Gulf economies are among the richest and most vibrant on the planet, helped by a Brent crude oil price that rose back to over $90 per barrel this week. A $3.5trn fossil-fuel bonanza is being spent on everything from home-grown artificial intelligence models and shiny new…

CITY AM – Retailers urge Hunt to slash tax A case for cutting business rates? Just look at our high streets CITY AM SAYS The pain is doubled thanks to the government’s inability to properly modernise rates for the twenty-first century; warehouse-based retailers continue to have an extraordinary competitive advantage over those with city centre premises. It’s a failure of leadership, and it’s short-sighted too. This isn’t about protecting old industries from new competition; plenty…

Apple shares slide after China government iPhone ban reports Shares in the US company Apple have fallen for a second day in a row after reports emerged that Chinese government workers have been banned from using iPhones. Over the past two days, the tech company’s stock market valuation has fallen by more than 6% – almost $200bn. China is Apple’s third-largest market, accounting for 18% of its total revenue last year. China is also where…

Elementor #549035 September 7, 20231 Min Read Summary of the Top 6 headlines today Financial Times – Bailey’s ‘top of the cycle’ signal casts doubt on more rate rises Governor of the Bank of England, Andrew Bailey, has indicated the UK could avoid further interest rate rises – sinking the pound against the dollar to the lowest rate for three months, the Financial Times says. The front page also reports the world has been put…