After a frosty and in places icy start, many areas will be dry and sunny, though feeling cold. Wintry showers will continue to feed into

The Chancellor’s tears spark market pain and huge £3bn panic sell-off, raising doubts over her future.

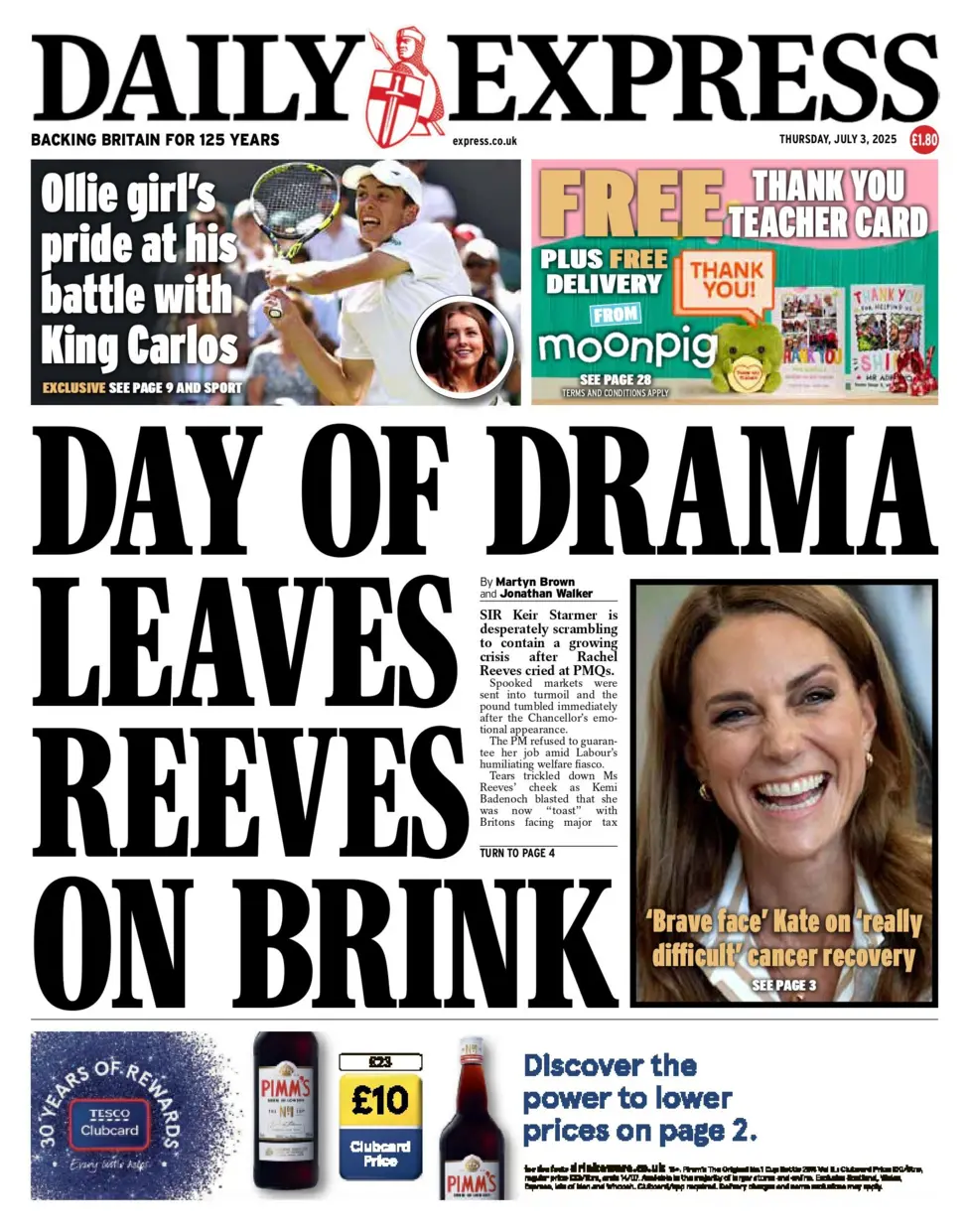

Almost all of Thursday’s UK newspaper front pages feature an image of Chancellor Rachel Reeves crying during Prime Minister’s Questions. The cause of the tears is the subject of much speculation this morning as some papers expect the chancellor to be sacked, whilst other front pages look at the reaction the markets had to the tearful episode.

Several of the papers look ahead to today’s NHS reforms, set to be announced by the prime minister. The 10-year plan is aimed at “rewiring the NHS” and improving services.

Princess Kate and the latest Wimbledon action are also pictured on many of the front pages.

For the tabloids, the P Diddy verdict is a hot topic as many were shocked at the mixed verdict. Diddy was acquitted of the most serious allegations but found guilty of prostitution. He is expected to still serve time behind bars.

The Chancellor’s tears spark market pain and huge £3bn panic sell-off, raising doubts over her future.

The music mogul Sean Combs, also known as P Diddy, has been cleared of the most serious accusations: racketeering and sex trafficking, but was found guilty of prostitution.

The Daily Express leads on the day of drama within Westminster after the chancellor appeared to be crying during PMQs yesterday. Her tears sparked concerns that she was about to be sacked, leading to a market sell-off.

Princess Kate is pictured on the front page as she opens up about her cancer treatment.

Yesterday’s Wimbledon action made the front splash.

Metro leads with the chancellor’s appearance at PMQs but focuses more on the backlash the PM is facing after his welfare reforms climbdown.

The i reports that the chancellor’s future is in doubt – though the PM has since announced the chancellor has his full backing and won’t be joining anywhere anytime soon.

The front splash also reports on Emma Raducanu’s Wimbledon success and P Diddy’s court case as he beats the most serious charges.

The Guardian leads with an image of the Chancellor sat behind the PM in tears as it notes Starmer was forced to defend Reeves after the welfare “fiasco.”

P Diddy’s court case verdict and a report that the IDF’s recent bombing of a cafe in Gaza make the front page.

The Daily Mail asks who or what caused the chancellor’s upset at PMQs.

At the top of the paper, Sarah Vine offers up her own opinion.

The entire front page is dedicated to “Labour’s 12 months of mayhem.”

The chancellor’s tearful appearance sparks a wide variety of headlines, but no one is happy about the ongoing chaos of the government, and everyone is asking if Starmer has lost control.

Irish police, known as Gardaí, have released CCTV images of 99 individuals they want to question about riots that broke out in Dublin nearly a year ago. The unrest followed

European Union nations are ready to step up military and financial support for Ukraine if the United States scales back its aid, Polish Foreign Minister Radoslaw Sikorski stated on Tuesday.

The UN Security Council is set to vote on Wednesday on a resolution demanding an “immediate, unconditional, and permanent ceasefire” in Gaza, along with the release of all hostages. However,

Médecins Sans Frontières (MSF) has halted its medical operations in Haiti’s capital, Port-au-Prince, citing escalating violence and a brutal attack on its staff. The decision follows an incident on November

President-elect Donald Trump has chosen Linda McMahon, co-founder of WWE and a long-time ally, as his nominee for education secretary. McMahon previously served as head of the Small Business Administration

Elon Musk, the world’s richest man, launched the sixth test of his SpaceX rocket with the US President-elect Donald Trump joining him to watch the launch – but sadly failed

G20 waters down support for Ukraine amid pressure for peace talks

FT.com Tweet

The Tech Titan Who Led His Company From a 68-Square-Foot Jail Cell

WSJ Business Tweet

Melrose Industries said it is on track to hit looming profit targets despite the industry-wide supply chain challenges plaguing the aerospace sector.

The Birmingham-based manufacturer said this morning it expects adjusted operating profit of between £550m and £570m this year and £700m in 2025.

In an update to markets, Melrose flagged a seven per cent year-on-year rise in revenue, driven by a 17 per cent jump in its Engines division.

Aerospace manufacturers, particularly the major planemaker’s Airbus and Boeing, have struggled to meet a significant ramp-up in post-Covid demand from their airline customers, as a result of long-running supply chain problems.

Huel, which counts the likes of Idris Elba, Steven Bartlett and Jonathan Ross among its investors, has reported record sales as a profit almost tripled during its latest financial year.

The Hertfordshire-headquartered company, which is known for its vitamin-enriched food items, has reported a revenue of £214m for the 12 months to 31 July, 2024, up from the £184.5m it achieved in the prior 12 months.

Huel’s pre-tax profit also jumped from £4.7m to £13.8m over the same period, according to new figures.

The business said its products are now sold in 25,650 stores, up from 11,250.

The average price tag on a newly marketed home dropped by over £5,000 in November as buyer demand revived in the wake of the Bank of England’s recent interest rate cut.

According to Rightmove, the standard price for a newly marketed home currently sits at £366,592, a 1.4 per cent month-on-month drop.

That downward trend is steeper than usual, with a typical November fall being around 0.8 per cent.

Rightmove said its data indicated that a fall in buyers approaching estate agents following the Autumn Budget, had been offset by a rise in buyer demand after the Bank of England lowered interest rates to 4.75 per cent in only the second cut this year.

UK inflation is expected to have jumped above the Bank of England’s two per cent target in October, bolstering a cautious approach to cutting interest rates in the months ahead.

A more gradual easing of monetary policy would be a headache for the new government, which has tried to reassure markets that last month’s big-spend Budget will boost economic growth without leading to runaway inflation.

Economists forecast the consumer price index (CPI), due on Wednesday, to come in at 2.2 per cent for last month, up from 1.7 per cent in September.

Higher energy prices are expected to drive the increase, with regulator Ofgem hiking its price cap on household bills by 9.5 per cent last month.

Copyright WTX News 2025