Tax rises likely as growth forecast cuts Western Mail says further tax rises are “likely later this year after the budget watchdog dealt Rachel Reeves a blow by halving its forecast for economic growth, despite huge cuts to welfare and a squeeze on Whitehall budgets. Farrell confirmed his Lions coaching team on Wednesday, made up of England senior assistant coach Richard Wigglesworth, Ireland coaching trio Simon Easterby, Andrew Goodman and John Fogarty, and Scotland forwards coach John Dalziel.

Author: WTX Business Team

The Atlantic magazine has published more excerpts of the Trump administration’s group chat on Signal that detail timings of military strikes in Yemen.

Rachel Reeves faces the prospect of her newly-restored fiscal headroom being wiped out again ahead of the Autumn budget.

City AM reports MPs and voters will “hear more” from the Chancellor on welfare cuts at the Spring Statement, the defence secretary has said.

The FT attacks what it calls the “sheer amateurism” of the Trump White House in the use of the messaging app to discuss plans to bomb Yemen.

FCA boos has said the watchdog is “going so much further” on its mission to boost growth in the UK.

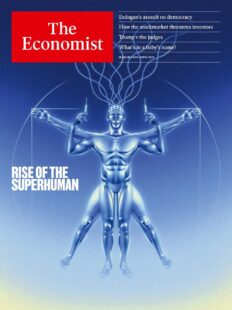

More and more people are finding ways to live longer and better.

US President Donald Trump is threatening more tariffs!

The front page highlights growing concerns about the UK economy, with warnings of a potential recession due to a “hiring slump.”

“Around the world, allies fear that America First means they come second, third or even last.”

The revised economic outlook This week’s Economist says Donald Trump’s economic delusions are already hurting America, saying the president and reality are drifting apart. Inside the paper it says this week Britain’s leader Sir Keir Starmer found his purpose abroad, saying he now needs the same at home.

The Financial Times reports the prime minister has pledged to take the heath system “back to democratic control” with support from the Conservatives.

The absolute 51st state of this CITY AM says the US-Canada trade war has heated up, and the president keeps pushing his desire to see America’s northern neighbour become the 51st state of the United States. The paper reports that Trump has escalated the trade war – Elsewhere, the paper reports the number of companies on the Alternative Investment Market (AIM) has sunk to its lowest level since 2001 after blitz exodus in the last…

Trump ratchets up Canada trade war with 50% aluminium and steel tariffs The FT leads with the back-and-forth of Trump’s tariffs and the impact on the stock market. The paper reports on the US president’s plan of targeting its northern neighbour with more tariffs – which would include a 50% tariff on aluminium and steel. The Trump administration has since rolled back on plans.

US recession fears spark market pain CITY AM reports on US recession fears after Donald Trump refused to rule out the fact that the US could slide into a recession, which sparked a global sell-off. The front page also reports on the collision between the oil tanker and vessel in the North Sea. The paper notes that fuel has been spilled into the water, sparking fears of an environmental disaster.

Wall Street plunges after Trump’s refusal to rule out recession The Financial Times reports on Wall Street’s plunge as US stocks declined on Monday due to fears of an economic slowdown after President Donald Trump did not rule out the possibility of his tariffs triggering a recession. The paper also features an image of Canada’s new prime minister, Mark Carney

Ukrainians to press Washington for resumption of aid in high-stakes talks The FT says Ukraine will try to persuade the US to resume intelligence and military support in high-stakes bilateral talks this week by convincing Donald Trump that Volodymyr Zelenskyy wants a swift end to the war with Russia. Elsewhere, Romania has banned the far-right frontrunner in the country’s presidential vote from taking part in the election, in a move that comes despite warnings from…

Brussels vows to back Kyiv The Financial Times headlines it as “Brussels vows to back Kyiv” and features a front-page image of the EU leaders and Volodymyr Zelensky at the summit in Brussels. European leaders announced a huge boost to defence spending agreed upon during the emergency meeting. The paper also reports that the Trump administration has “backtracked further” on its 25% tariffs on Mexico and Canada. The paper calls it a “big climbdown from its aggressive…

Berlin defence funding shift triggers huge bets on growth The Financial Times reports that investors are betting on a “big boost” to Germany’s “ailing economy” as a result of a “historic” deal to fund military and infrastructure development. Analysts believe the plan could boost economic growth to as much as 2% next year, the paper says. China’s Xi has set out ambitious growth targets for the country despite trade tensions with the US hurting China’s economy.…

Yet another growth hit for Reeves CITY AM reports the Chancellor’s growth agenda was dealt a fresh blow on Thursday after the British Chambers of Commerce slashed its forecast for the UK economy due to the tax and trade “double whammy” afflicting UK businesses. The business group now expects the UK economy to grow by just 0.9 per cent in 2025, a hefty downgrade on the 1.3 per cent growth it envisaged for the economy…

Defence is the best form of attack City AM reports Labour is now rated above the Conservatives for who is best to handle defence and national security, with an extraordinary 13 points shift towards the government since just last month. The government have firmly parked their tanks on what is usually considered a Conservative stronghold, an ominous sign for the opposition. While still far from the top issue, defence and national security are up six…

Europeans move towards seizing €200bn of frozen Russian assets The FT reports on Europe’s preparation to take over from the US. The paper says Europe’s biggest powers are moving towards seizing more than €200 billion in frozen Russian assets. The paper says France and Germany, who had long opposed a full-blow seizure of the assets held in the EU, are now discussing with the UK and other countries how they could be used. In more USA…