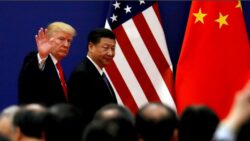

Despite opening well this Friday morning, the three main stock indexes in Europe are now down after China announced that it will retaliate further to US tariffs – after the Trump administration confirmed the tariff on China is now 145%.

Author: WTX Business Team

You don’t have to be a business major to be interested in the stock markets, and unless you’ve been living under a rock these last few days, it’d be almost impossible for you not to have heard about a stock market crash.

Since Donald Trump announced his ‘Liberation Day’ tariffs you would have heard a lot about the stock markets, them crashing and fears of a global recession.

Here’s a simple guide to the stock markets and what they mean.

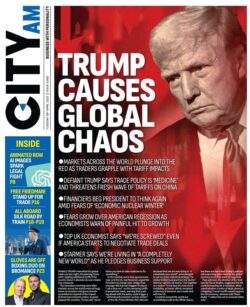

Trump causes global chaos Tensions between the world’s two largest economies have increased overnight as Beijing vowed to “fight to the end”, in response to a new wave of US tariffs. The statement followed a dramatic escalation by President Donald Trump, who threatened an additional 50 per cent tariff on Chinese goods, unless Beijing reverses its newly announced 34 per cent reciprocal levy – retaliation for Trump’s earlier 34 per cent tariff hike on Chinese…

Trading has just restarted in Europe and all the main stock markets are showing a slight rebound from the previous falls.

There have been a few big announcements from China today – the latest outlines new restrictions on US companies.

BBC’s business editor Simon Jack was asked: Is this a stock market crash? Here’s what he has to say:

Stock markets in London, Paris, and Berlin fell on Thursday following U.S. President Donald Trump’s announcement of sweeping tariffs. The UK has been hit with a baseline 10% while the EU has been hit with 20%.

Sir Keir Starmer has vowed to “keep a cool head” in the face of the “economic impact” of Donald Trump’s 10 per cent tariffs on UK exports to the US, amid fears of a wider trade war.

The FT reports that it has seen an informal paper that the UK government has circulated outlining its plans for a multilateral fund that would support weapons stockpiles and military equipment across the continent.

A look at the market jitters ahead of the new round of US tariffs – with US media speculating it is set to be a blanket 20% tariff on all non-American goods.

The FT looks at investors and says they are “flocking to gold as fears mount on eve of Trump tariff announcement.”

Trump’s planned ‘Liberation Day’ tariff deluge could send a wrecking ball through the Chancellor’s buffer.

French far-right leader Marine Le Pen has been banned from standing for office for five years with immediate effect and sentenced to jail after being convicted of embezzling EU funds.

The UK government had been holding out hope for a “UK-US economic prosperity deal” that would protect British exports from the tariffs

The US President suggested his next round of tariff announcements, expected on Wednesday, will hit all countries, rather than just those who sell more goods to the US than they buy.

The Economist asks: Is Elon Musk remaking government or breaking it?

The US is increasing pressure on Russia, threatening further tariffs on its oil exports if a ceasefire agreement in Ukraine isn’t reached.

Steel tycoon Lakshmi Mittal is preparing to leave the UK in response to a government crackdown on non-domiciled residents, making him one of the wealthiest entrepreneurs to move because of the tax reform.