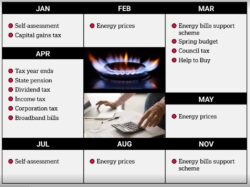

All the biggest dates this year that will impact Brits (and their bank accounts) (Picture: Metro.co.uk)

It’s safe to say people were glad to see the back of 2022.

In Britain, the year brought with it three new prime ministers, swelling food and fuel prices and a lot of anxiety over money and the future.

But what should we expect for 2023?

Here are some of the key dates this year for you and your bank account:

It’s the most wonderful time of the year – tax season.

By the end of the month, self-employed Brits, high earners and those with income not taxed at the source should file their Self Assessment tax returns.

Settling any outstanding tax bills for the past year is also on the to-do list.

CAPITAL GAINS TAX

Capital gains tax is the tax paid on the profit from the sale of things like stocks, bonds and real estate.

January 31 is the final day people can make their capital gains payments.

People have an allowance of £12,300 for the current tax year but, under chancellor Jeremy Hunt’s plans, the allowance will be slashed to £6,000 from April.

Since October last year, energy prices have been capped – preventing skyrocketing bills this winter.

From the end of February, energy regulator Ofgem will announce a new energy price cap – the maximum price suppliers can charge consumers.

The energy price guarantee will still shield Brits from what could be another hike as winter melts away.

This means that people won’t have to worry about how much the cap changes – the only difference will be the price the government pays to keep the guarantee running.

Right now, the price cap is anticipated set to rise to an annual level of £4,279 in January.

The final £400 Energy Bills Support Scheme cheque, which partly subsidised household fuel bills, will be sent.

Payments have been made monthly since October.

SPRING BUDGET

Jeremy Hunt will set the tone of Britain’s economic recovery on March 15.

We’re not sure what it will include, but Hunt’s ‘mini-budget’ involved a raft of tax increases and public spending programme cuts.

COUNCIL TAX

Speaking of taxes, one of the first of Hunt’s hikes will be on council tax.

Councils will be able to raise the amount residents pay by 5% without a vote.

Spending watchdog the Office for Budget Responsibility expects this to raise nearly £42 million, or about £1,480 per household.

HELP TO BUY

The Help to Buy equity loan scheme – which saw the government lend first-time buyers in England cash to buy a new build – will be wound down.

But applications for the loan ended last October.

All homebuying hopefuls will have until March 31 to complete their purchase.

RAIL FARES RISE

Adding to Brits’ seemingly endless list of financial woes, the government’s freeze on rail fares will thaw on March 5.

Usually, the price for a rail ticket is tied to inflation, but the government has said fare increases will be capped at 5.9%.

Then prime minister Liz Truss intended to protect Brits from some of the worse energy price hikes for the two years.

But under Rishi Sunak’s belt-tightening budget, the Energy Price Guarantee will no longer be universal from April.

Instead, the guarantee will rise to a higher level, meaning the average household will pay about £3,000 for their annual energy bill.

The guarantee will be in place until April 2024.

Though, thanks to unseasonably warm weather leading to Europe using less gas, the price cap rise might not be as dizzyingly high as expected.

Energy consultancy Cornwall Insight expects Ofgem’s new cap to fall by £600.

TAX YEAR ENDS

April 5 is the final day of the tax year and the deadline to use up savings allowances, such as Isas and pensions.

Though, investors can pay into stocks and shares Isa and hold it as cash if they don’t want to rush an investment.

Annual pensions contributions allowances of £40,000 will also reset.

STATE PENSION

The Treasury confirmed in November that state pensions would rise in April to match inflation.

From April 10, state pensions will increase by 10.1%, meaning they will be boosted by a record £972.40 to £10,600.20 a year (or £203.85 a week).

INCOME TAX

High-earners will now have to pay more income tax from April 6.

Income tax itself hasn’t gone up, but instead, the threshold at which people start paying or move into a higher band has lowered.

Now those earning over £125,140 will fall into the 45% top rate, rather than £150,000.

DIVIDEND TAX

The tax-free allowance shareholders get on dividends will fall from £2,000 to £1,000 per person.

CORPORATION TAX

More tax increases – the tax businesses pay from their profits will increase from 19% to 25%.

BROADBAND AND PHONE BILLS MAY RISE

Brits might have to brace themselves for even higher bills.

Broadband, phone and water suppliers tend to raise their prices every April to match the consumer price index published in January.

On top of that, broadband providers whack an additional 3.7-3.9%.

If you’re at the end of your contract, now might be the best time to cancel it and lock in a new deal.

BUT WATER MIGHT GO DOWN

When it comes to water, however, there will be a sigh of relief as those costs should go down.

Water firms didn’t quite meet the targets imported by water regulator Ofwat on issues like pollution.

Though, because inflation rates are so stubborn right now, some firms might raise prices anyway.

Ofgem will once again revise its cap level that will dictate energy bills for the bulk of Britain from July to September.

According to the Investecc bank, people could expect the bills to fall to £2,640 a year in July.

Consumer Duty is a pretty simple concept: people should be protected when they buy things.

The set of safeguarding practices for new and existing financial products and services will be more stringent than before.

So consumers should expect rip-off charges and fees to come to a long-sought end.

Remember how easy it was to sign up for a product, like a mobile phone bill? Well, it’ll be just as easy to swap or cancel products from June – fingers crossed.

Customer support will be faster to access too

The Financial Conduct Authority, a financial watchdog, will enforce the duty and gave firms 12 months to get up to code in 2021.

USE THOSE NON-BARCODED STAMPS

Some first and second-class stamps that don’t have a barcode will have to be used by July 31.

This will include ordinary stamps such as those with the late Queen’s profile.

All eyes will be on Ofgem once more as the regulator revises its cap from October to December.

This will be especially poignant for Brits wary of a chilly winter ahead.

It can be hard to think so far ahead but, in October, the cap should hit just over £2,700, Investec estimates.

INFLATION

Inflation is the loss of purchasing power over time – so your pounds don’t go quite as far as they once did.

The rate is announced by the Office for National Statistics each month, but the July rate – announced on August 16 – is used to set any rail fare increases from next year.

Hunt – well, if he’s still around at least – will likely outline his next big fiscal plan, the Autumn Budget, in November.

INFLATION… AGAIN

The inflation rate figure for September that will be unveiled on October 18 is also a very important one.

It’s used to calculate a lot, such as social welfare, state pension and tax credits.

Take the triple lock, this is when state pensions are increased by the largest of three figures: 2.5%, inflation or earnings growth.

The 2021 scheme was meant to end last year, but the Treasury revived it for another year.

They had good reason to – there’s been major concerns over falling house prices. This year’s recession, expected to be long and painful, will reduce the number of low-deposit mortgage deals.

Under the mortgage guarantee, first-time buyers would scoop up a property with just a 5% deposit.

Get in touch with our news team by emailing us at [email protected].

For more stories like this, check our news page.

From how much you’ll be paying for energy to the many tax rises.