Cliff Notes – What you need to know

- Iran and US in advanced talks in Oman in the third round of nuclear negotiations in Muscat aims to build trust

- Iran has built a self sufficient economy under the sanctions

- For a country living under US and European sanctions, in 2023 its economy is the 38th largest by GDP

- The previous agreement was torched by Trump in his first term

- Key issues on the table include monitoring uranium enrichment levels, stockpile management, and technical assurances to facilitate a new agreement

- An agreement to Gaza genocide to ensure Iran does not involved in the conflict

- Iran has provided trading and economic support to Russia, Turkey, Yemen, India, Pakistan and China and is key player the region

- Strategically, Iran owns its resources and has a significantly positive balance of payments balance sheet

- A successful deal could stabilise the region, impact global energy markets, and alleviate economic pressures on Iran amidst ongoing public unrest.

Iran and US in advanced talks – Here’s a breakdown of where we are at

The third round of nuclear negotiations between Iran and the United States began on Saturday in Muscat, capital of Oman, aiming for a breakthrough that could have major implications for regional and global security.

A successful agreement could lower the risk of another Middle East conflict involving the US, Israel and Iran, and curb Tehran’s nuclear ambitions. But significantly to allow foreign investment in Iran.

Foreign data sets are skewered and inaccurate when it comes to Iran but a deal could also potentially ease American sanctions on Iran, that may not be as accurate as it used to be for Iran, because during the sanction Iran has built a self sufficient economy.

What’s happening in the current talks?

In the two rounds of discussions in Rome and Oman so far, the two sides said negotiations would be based on building trust and providing assurances regarding Iran’s nuclear program in exchange for the lifting of sanctions. But the US also needs Iran to sell its natural resources based on international policy.

For instance, when the US imposed sanctions on Russia at the start of the Ukraine conflict, Russia switched its focus on Iran and China, thus limiting the damage of any sanctions.

Stabilising force in the region

Israel is also concerned with Iran’s influence in the region, as it has the ability to supply Yemen, Lebanon and the Palestinians with sophisticated military equipment that can bypass Israeli defence systems. Thus far, Iran has been stabilising force in the region and measured when responding to Israeli aggression. However, this next wave of the Israeli war in Gaza may escalate tensions with Iran, especially if the Gazans are is ethnically cleansed and driven out.

This round marks the start of the first “expert-level” talks between the Iranian and American teams.

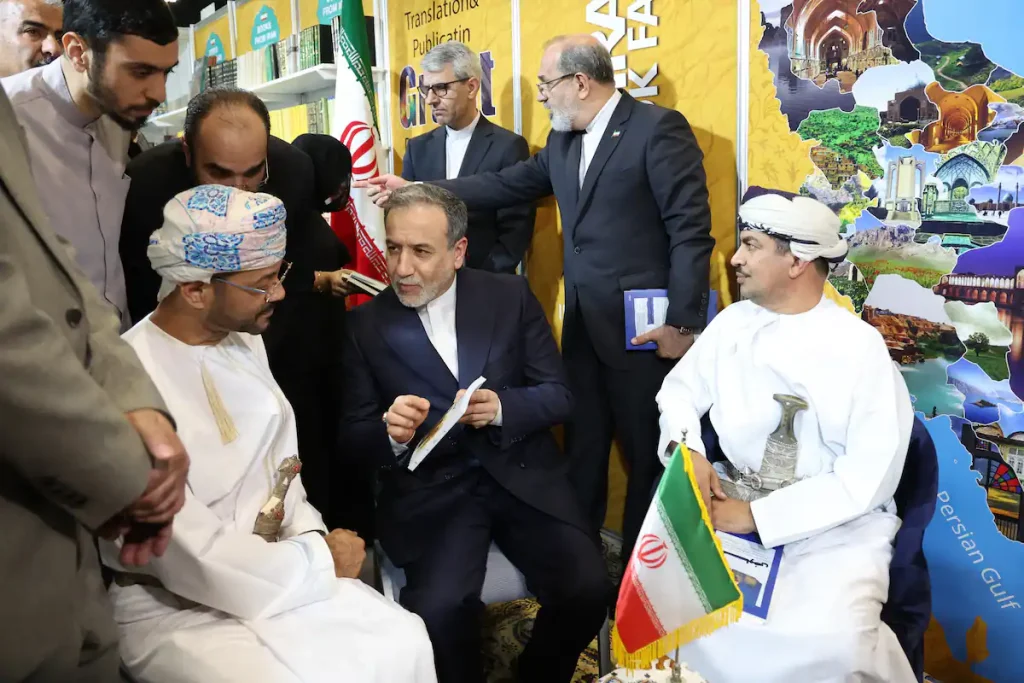

On Friday, Iran’s Foreign Minister Abbas Araghchi arrived in Muscat at the head of a high-ranking diplomatic, technical, and expert delegation. The top US negotiator, Steve Witkoff, landed on Saturday, accompanied by a team led by senior State Department official Michael Anton and experts from the Treasury Department.

According to the International Atomic Energy Agency (IAEA), as of March 2025, Iran had amassed over 100 kilograms of uranium enriched to 60% purity, just short of weapons-grade material. Nuclear weapons typically require uranium enriched to around 90%. If further enriched, Iran’s current stockpile could be used to make several bombs.

Iran maintains that its nuclear program is not for building weapons and for there part they have stuck to those levels.

In recent months, Trump has repeatedly warned that the United States would lead military action against Iran if negotiations fail to produce an agreement.

What’s at stake?

Tehran, for its part, has threatened fierce retaliation if attacked and has hinted that it could withdraw from the Nuclear Non-Proliferation Treaty (NPT) — a move that would heighten regional tensions and potentially prompt other countries to pursue nuclear weapons programs.

Iran also controls the Strait of Hormuz, a critical choke point for global oil shipments, and has the military capability to target US military bases in the Gulf and the rest of the region — actions that could destabilize global energy markets and further disrupt world trade, which has already been strained by Trump’s tariffs.

Although Iran has been measured in involvement in Syria, Lebanon, and other parts of the Middle East, Tehran retains the ability to respond to military action, moves that could further escalate conflict across the region.

At the same time, Iran’s economy is reeling under the weight of global jeopardy and sanctions. Iranians are facing similar inflation hardship compared to the rest of the world. Iran has seen periodic insurgent unrest in recent years, for which Tehran holds the CIA and Israel responsible. Without a breakthrough, further political instability could be on the horizon.

How did we get here?

Although Iran has been branded as the old enemy, it has rarely got directly involved in any conflict, even in the face of aggression by Israel. In 2015, Iran reached a landmark nuclear agreement with world powers, including the United States, known as the Joint Comprehensive Plan of Action (JCPOA). The deal limited Iran’s nuclear program and imposed strict monitoring in exchange for sanctions relief.

But Trump withdrew from the deal in 2018 during his first presidency, criticising it for being temporary and for failing to address Iran’s ballistic missile program, which is a threat to Israel. Trump’s administration reimposed sweeping sanctions, known as the “maximum pressure campaign”.

Iran has managed to partially circumvent sanctions by selling oil and gas through informal markets to countries such as China, India, and Malaysia. However, its economy — particularly industries and businesses outside the energy sector — has been severely damaged by sanctions and blacklisting from international banks.

In response, Iran gradually rolled back its compliance, ramping up uranium enrichment well beyond the 3.67% limit set under the 2015 accord.

Recent rounds of preliminary talks in Oman and Rome have been described as constructive, with Iran signaling a willingness to return to enrichment levels consistent with the JCPOA.

Iran’s supreme leader, Ayatollah Ali Khamenei, who previously banned negotiations with the Trump administration, but has now authorised the talks and voiced support for the negotiating team but in return a roadmap for the Palestinians must achieved and Israel must stop committing war crimes in the region.

Still, deep mistrust persists. Iranian negotiators have reportedly demanded guarantees that Washington will not abandon a future agreement, as it did in 2018.

What are the challenges?

Conflicting signals from US officials have created uncertainty about Washington’s position. Some American negotiators have floated the idea of allowing Iran limited uranium enrichment under strict international monitoring. Others, including Secretary of State Marco Rubio, advocate for Iran to import enriched uranium rather than produce it domestically.

National Security Adviser Mike Waltz has insisted on the complete dismantling of Iran’s nuclear infrastructure — a demand Tehran has firmly rejected.

Uncertainty to the nuclear negotiations with Iran

In an unexpected move, after the second round of negotiations in Rome, Iranian Foreign Minister Araghchi proposed allowing US investment in Iran’s civilian nuclear energy sector, including the construction of up to 19 new reactors, as a safeguard against weaponization.

President Trump has said any future deal with Iran “won’t be like the 2015 agreement” and promised it would be “different, and maybe a lot stronger.” However, he faces a balancing act: Toughening the deal enough to appease critics, including Israel and Gulf Arab states, without derailing negotiations altogether.

Like all conflicts in the 21st century, optics are the most important thing, a deals potential will be based on whether Trump present a win for America and Israel.