- Pentagon Confirms 5th U.S. Soldier Killed in Iran Drone Strike Crisis

- EU countries give final approval to 2040 climate target for 90% emissions cut

- Senate vote fails, allowing continued US military action against Iran

- EU Scraps Emissions Label Ahead of Industrial Accelerator Act

- X reports significant decline in user numbers across the EU for 2025

- EU Urges Ukraine to Permit Access to Key Russian Oil Pipeline Today

- Premier League — Wednesday’s 4th Mar fixtures

- US and Israeli Airstrikes Lead to High Casualties in the Gulf

Financial Times - Biden presses Belfast parties

Summary of the front page

The Financial Times says Joe Biden’s visit to Northern Ireland, commemorating 25 years of the Good Friday Agreement.

The paper focuses on Mr Biden’s appeal to Northern Ireland’s political parties and carries a photo of the leader with actor James Martin who recently starred in the Oscar-winning film An Irish Goodbye. The president will spend the rest of his trip in the Republic of Ireland, the paper notes.

Today's top stories

Pentagon Confirms 5th U.S. Soldier Killed in Iran Drone Strike Crisis

Media Lens: Pentagon Confirms 5th U.S. Soldier Killed in Iran Drone Strike Crisis Story focus: Pentagon names soldiers killed in

EU countries give final approval to 2040 climate target for 90% emissions cut

New target aligns with the ongoing debates about the EU’s resilience to broader geopolitical challenges, particularly in the context of energy supply security and climate diplomacy amidst global concerns.

Senate vote fails, allowing continued US military action against Iran

Senate vote fails, allowing continued US military action against Iran Explosions have been reported in Tehran as US and Israeli

EU Scraps Emissions Label Ahead of Industrial Accelerator Act

EU EMISSIONS LABEL

This morning, the European Union abandoned its emissions label plans for steel.

Industry concerns prompt a shift towards supporting low-carbon steel demand instead.

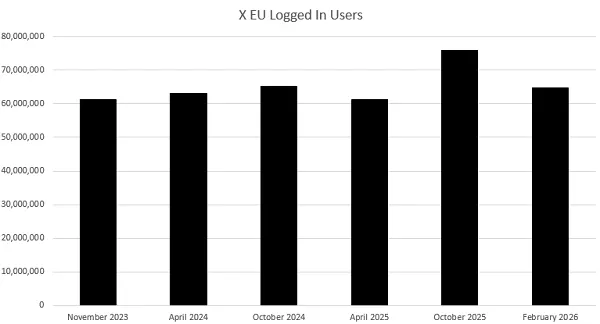

X reports significant decline in user numbers across the EU for 2025

X USAGE DECLINE

This morning, data reveals X usage in the European Union has significantly declined.

Moderation staffing levels have also dropped sharply.

EU Urges Ukraine to Permit Access to Key Russian Oil Pipeline Today

EU Urges Ukraine to Permit Access to Key Russian Oil Pipeline Today EU officials are pressing Ukraine to allow access

Like this article?

News Desk

Leave a comment

From our sponsors

Subscribe to News

Get the latest news from WTX News Summarised in your inbox; News for busy people.

Advertisement

Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.